I write this following the sobering news that since the pandemic began earlier this year, Australia has lost about $35b in economic activity, and our annual growth contracted by just over 6%. After six months of continuous negative growth, we are officially in recession. However, as dire as all this is, we can take some comfort that we are not faring as poorly as the US, UK and European nations, where each economy contracted 10%, 20% and 12%, respectively.

As well, Aussie households enduring lockdown – with not much to spend money on – have amassed the largest savings since the early ‘70s. Some of that pile is also due to the extraordinary rates of government-funded income support, tax relief and a range of mortgage, council rates and other payment deferrals. We should never overlook that the job support payments provided to businesses have been vital to maintaining a workforce. It has also put food on tables, paid rents, and kept families together. However, as we prepare for a new wave of policies and packages to stimulate the economy, including injecting confidence into consumers and encouraging businesses to grow, we should also be mindful of the unintended consequences of subsidies.

“Mortgage, tax, and rate relief that have been key to the survival of some households and businesses will soon come to an end.”

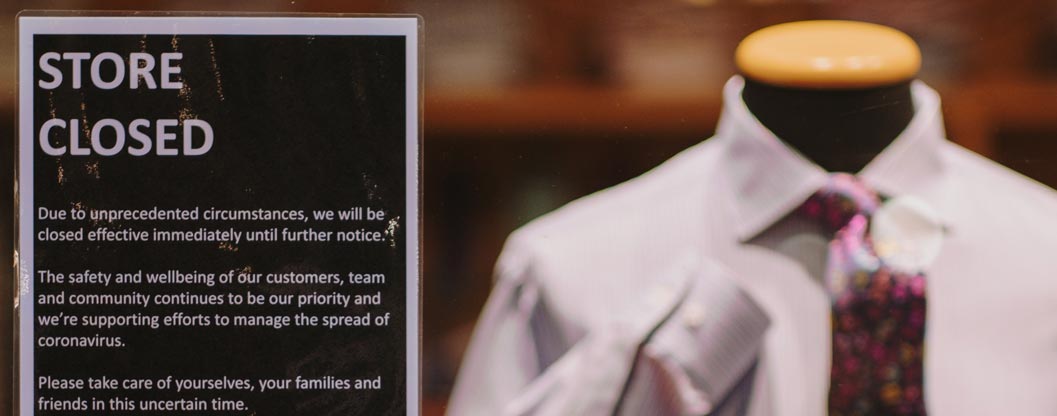

The sad reality is that some businesses that were not viable at the beginning of the pandemic have been able to limp along, trading longer than they should have, with the aid of cash subsidies and relief schemes. The lifeline that allowed failed and failing businesses to keep functioning has unfortunately affected other businesses, often left to drown in the unpaid bills of subsidised, unviable operations. With pressure on companies not to chase debts, the effects multiply. This means bankruptcies and insolvencies as more businesses become entangled in the spiral.

Mortgage, tax, and rate relief that have been key to the survival of some households and businesses will soon come to an end. Our experience is that most people prioritise paying mortgages and services, like electricity and telephone accounts, over other debts. This means that government debt, including rates, taxes and services, will be difficult to recover. Local Government, in particular, will struggle to get paid.

The key for financially stressed businesses and households is to reach out early so that ways to repay debt can be developed. The caveat however is that whilst financial counsellors are usually helpful in getting a repayment pathway organised, their services are already stretched. Some simply can’t take on any more cases.

What is needed is a debt recovery community education campaign, along with more creative strategies and processes, like minimum payment and deferral arrangements, that provide a way out.

It is only with careful planning that we can get through this and create a stronger Australia.